An endowment provides a perpetual source of income for scholarships, faculty and University programs for generations of Clemson students. Your gift to an endowment, the principal (or corpus), is invested long-term and a portion of the annual earnings are paid out to support the designated purpose for which the endowment was established. The goal is to ensure that the principal maintains its purchasing power over time to support future generations.

As other sources of revenues such as state appropriations, grants and research sponsorships can be unpredictable, an endowment provides a consistent, reliable, perpetual source of income for programs and services that inspire and fund above-average achievement by students and faculty. The larger the endowment is, the greater the income that can be provided; and therefore, the more opportunities available for students, faculty and University programs.

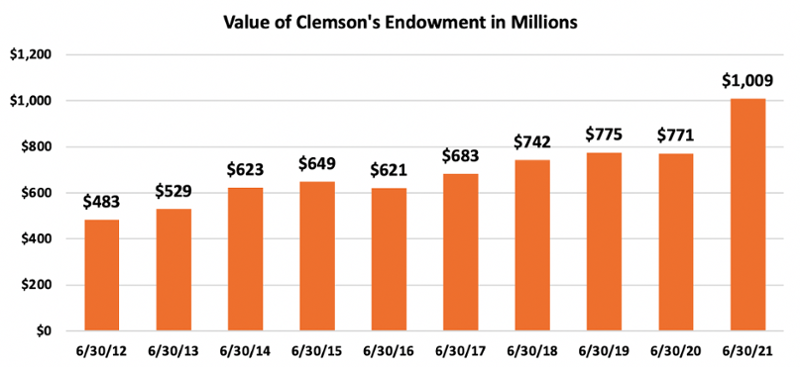

The Value of Clemson’s Endowment on June 30th of 2012 was $483 million. On June 30th of 2013 it was $529 million. On June 30th of 2014 it was $623 million. On June 30th of 2015 it was $649 million. On June 30th of 2016 it was $621 million. On June 30th of 2017 it was $683 million. On June 30th of 2018 it was $742 million. On June 30th of 2019 it was $775 million. On June 30th of 2020 it was $771 million. On June 30th of 2021 it was $1 billion 9 million.

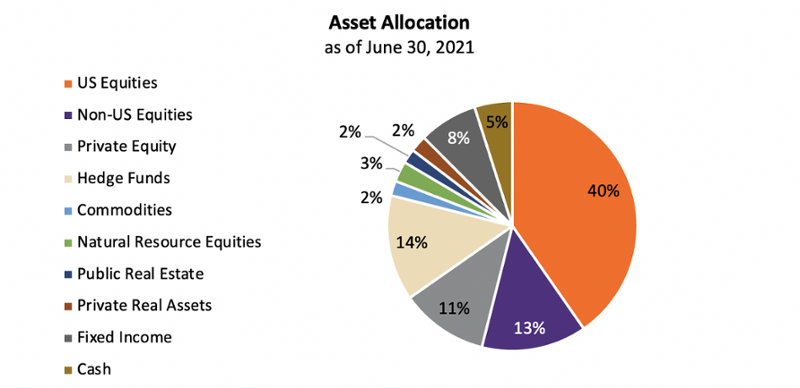

As of June 30, 2021, the following is a breakdown of asset allocations.

As of June 30, 2021, the following is a breakdown of asset allocations.