APPROPRIATION BUDGET

One of the four types of budget ledgers within CUBS that organizes budgets by Budget Center. The appropriation budget acts as the spending authority and budget control level for funds 10-18.

ACCOUNT NUMBER

The account number is a numeric string compiled by using all six chart fields from the University's official Chart of Accounts. The Chart of Accounts is maintained by Accounting Services using the CUBS system. These strings are used to classify, record, and report financial data and program activity. There are three basic types of accounts in Clemson University's accounting system. These are expenditure accounts; revenue accounts; and asset, liability, additions and deductions to fund balance and fund balance accounts. For a detailed explanation of the University's accounting system, please refer to Clemson University Policies and Procedures for the Accounting Services Division at https://cubs.sites.clemson.edu/fscm/Chart_of_Accounts_Overview.pdf.

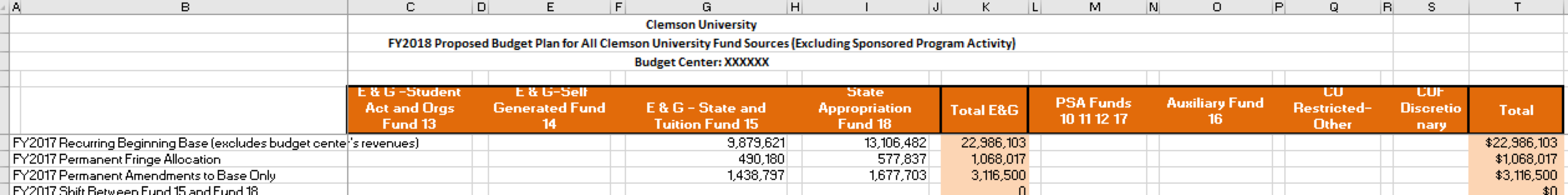

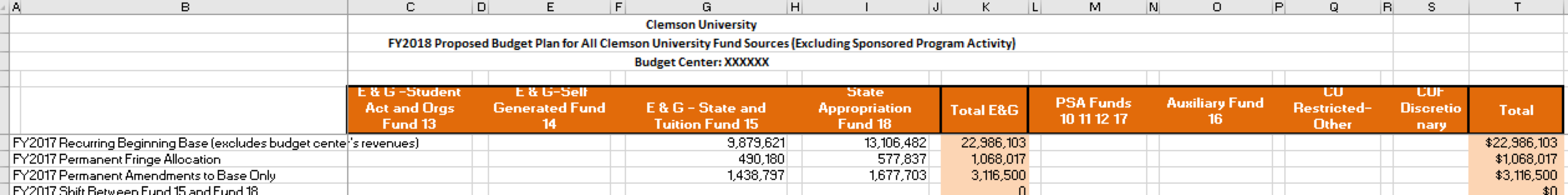

ALL FUNDS BUDGET WORKSHEET

Formatted spreadsheet provided to Budget Centers for the planning and preparation of detailed budget submittals. The worksheets provide the current year's budget and estimated expense, last year's budget, and a blank column in which to enter upcoming fiscal year's budgeted amounts. Salaries and fringe benefits determined from salary roll data entered earlier in the budget process for the upcoming year are preprinted on the form.

ANNUAL OPERATING BUDGET

A detailed projection of anticipated revenues and expenses from all sources and for all budgeted activities for one fiscal year, developed by the University and approved by the Board of Trustees. The annual operating budget is effective for the 12-month fiscal period between July 1 of one year and June 30 of the following year.

AUXILIARY ACTIVITIES

Activities that primarily furnish goods and services to students, faculty, staff, or the general public, charging a fee directly related to cost. These activities are essentially self-supporting. Examples of auxiliary activities are athletics, housing, dining services, and the bookstore. Auxiliary accounts are found in Fund 16.

BASE BUDGET

The ongoing and recurring budget for each Budget Center of the University. Changes in the base can be permanent or temporary.

BUDGET AMENDMENT

An increase or decrease to an alphanumeric budget account string. Amendments may be non-permanent or permanent. Permanent amendments are changes that permanently affect the base budget allocated to a Budget Center. Non-permanent changes are one-time changes that only affect the spending authority of a Budget Center during the fiscal year in which it is made. Instructions for preparing Budget Amendments can be found at http://media.clemson.edu/cfo/budgets/PeopleSoft-Budget-Training.pdf. The Budget Amendment form can be found at https://www.clemson.edu/finance/budgets/forms.html.

BUDGET AMENDMENT FORM

Template used as a source document for changing amounts budgeted differently from the original system-loaded balanced budget. This form must be used for revenue and appropriation budget changes and must be routed through the University Budget Office. The Budget Amendment form can be found at https://www.clemson.edu/finance/budgets/forms.html.

BUDGET CENTER

A grouping of identified, cost-related departments. Each Budget Center's financial affairs are managed through what is commonly referred to as a Business Officer who is the chief point of contact for each center for all budget matters. For a listing of the Budget Centers and their departments, please refer to https://coa.app.clemson.edu/Dept_by_bud_center.php . Business Officer names can be found under the Campus Business Officers Group tab at http://www.clemson.edu/finance/teams.html.

BUDGET CHECKING (Commitment Control)

The coded system of edit checking within CUBS that ensures a budget is established and in certain instances, funded, before an expenditure or revenue transaction may be processed through the General Ledger posting process.

BUDGET STATUS REPORTS

Revenue and expenditure reports generated on a monthly basis through the Clemson University Business Systems (CUBS) and made available to all University units via the Business Data Warehouse. These reports reflect actual posted activity and encumbrances as compared to budget activity.

CENTRAL FISCAL UNIT (CFU)

A temporary budget account established at the time the University's budget is finalized for budget items earmarked for a specific purpose when the actual amount to be distributed to various unit is not known.

CLEMSON UNIVERSITY BUSINESS SYSTEM (CUBS)

Clemson University's internal accounting system through which all business and financial transactions are organized, recorded, reported, and managed. CUBS maintains all university accounts in accordance with a system of fund accounting. CUBS is an internal acronym given to the financials and human resource management systems distributed by People Soft Systems, Inc.

COMMISSION ON HIGHER EDUCATION (CHE)

An agency established by act of the General Assembly responsible for the coordination of higher education in the state to achieve more effective and efficient programs and services at the state's institutions of higher learning.

FACILITIES AND ADMINISTRATIVE COSTS/ INDIRECT COSTS

Costs the University incurs for common or joint objectives and therefore, cannot be identified readily and specifically with a particular sponsored project, an instructional activity, or any other institutional activity. Costs such as building and equipment use charges, computer equipment depreciation, plant maintenance, administrative and general, indirect departmental expense, sponsored projects administration, library services, and a departmental administration allowance are reimbursed to the University at a percentage rate.

FISCAL YEAR

The annualized, accounting cycle established for Clemson University occurring from July 1 through June 30.

FUND ACCOUNTING

A methodology that identifies and classifies resources according to their intended use into specific units called funds. Resources are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions, or limitations. Within each fund, costs are broken down by functional programs such as instruction, research, extension and public service, academic support, institutional support and department administration; and by object of expenditure such as personal services, fringe benefits, supplies and other, scholarship, fellowships and grant-in-aid, and equipment. For a detail explanation of the University's accounting system, please refer to Clemson University Policies and Procedures for the Accounting Services Division which can be found at https://cubs.sites.clemson.edu/fscm/Chart_of_Accounts_Overview.pdf.

FUND BALANCE

Most simply, fund balance is the difference between assets and liabilities in a governmental fund. Most commonly in CU budgeting, Fund Balances and Performance Credits may both be terms applied to funds that are unspent in the current year, but that may be available to spend in the upcoming year. These funds exist in general ledger funds 12, 13, 14, 15 and 16. Funds 13, 14, 15 and 16 are managed by the University Budget Office. Fund 12 is managed by the PSA Business Office. For more details on Fund Balance, see Section Fund Balances and Education and General Performance Credits in the University Budget Office Policy Manual at https://www.clemson.edu/finance/budgets/.

GENERAL AND ADMINISTRATIVE COSTS (G&A)

A type of indirect cost incurred for the general executive and administrative offices of the University and generally other expenses which do not relate solely to instruction, organized research, other sponsored activities, or other institutional activities.

HUMAN CAPITAL PLANNING (HCP) (a.k.a.Salary Roll)

Generated listing of budgeted vacant positions and active employees with related information provided to Budget Centers for the preparation of budgets during the spring of each year. The salary roll lists the distribution of each salary among account numbers for each permanent classified and unclassified position entered into the position database. The sums of these distributions are transferred to the budget worksheets and included in the total base budget loaded into the Clemson University Business System (CUBS). Training for HCP can be found at https://www.clemson.edu/finance/budgets/ under the heading Training and Events: FY20xx Position Planning Training Manual.

NON-PERMANENT BUDGET AMENDMENT

Changes to a budget which do not affect a Budget Center's permanent base budget.

ORGANIZATION BUDGET

The CUBS system organizes departmental budgets by organization or department number. Organization budgets are required for funds 10-18 due to the commonality of funding being limited to a singular fiscal year. The sum of all organization budgets for a Budget Center should not exceed the appropriation budgets (spending authority) for that center.

PERFORMANCE CREDITS

An incentive mechanism that provides greater budgetary flexibility and discretion to Budget Centers by allowing the carry-over of fiscal year-end balances within certain guidelines. The performance credit initiative promotes a greater efficiency of spending across the University. For more details on Performance Credits, see Section Fund Balances and Education and General Performance Credits in the University Budget Office Policy Manual at https://www.clemson.edu/finance/budgets/.

PERMANENT BUDGET AMENDMENT

Changes to a budget which permanently affect a Budget Center's base budget.

PROJECT GRANT BUDGET

The CUBS system organizes budgets at the project grant level. Project grant budgets include detail budgets for all six chart fields of the University's chart of accounts. Funds 19 and higher require project grant budgets due to the commonality of funding resources crossing multiple fiscal years.

PUBLIC SERVICE ACTIVITIES (PSA)

As a land-grant university, Clemson is part of a national system created by the U.S. Congress to improve the quality of life for citizens in every state through teaching, research and outreach. While faculty members teach Clemson students, Clemson Public Service and Agriculture (PSA) conducts research and outreach programs to improve the quality of life for citizens in South Carolina. At the CU Budget Level, PSA funds are housed in Funds 10, 11, 12 and 17, and are found in Budget Centers in which there are public service related programs. At the State Budget level, PSA includes Agricultural Research (includes Agricultural Experiment Stations), Cooperative Extension, Regulatory and Public Service Activities, Livestock-Poultry Health, Forest and Recreation Resources, State Energy Programs and Bio-engineering Alliance.

REAL FOUNDATION FUNDS

REAL is the acronym that stands for the four major strategic priorities in the Clemson Forward initiative, developed in the 2016-2017 year. The letters stand for Research, Engagement, Academic Core and Living. Some funds provided from central administration to campus units are described as REAL Foundation funds; so named as they are considered “foundation investments”.

REVENUE BUDGET

The CUBS system organizes projected revenues by project grant level of budget detail. All six chart fields are required for the revenue budget-all at the greatest detail level except for the program chart field. Only funds 10-18 require a revenue budget.

REVENUES (DEPARTMENTALLY GENERATED)

Revenues generated by, or allocated to, a Budget Center. These may include such sources of funding such as seminars and short courses, laboratory fees, facilities and administrative costs, general and administrative charges, and other cash revenues generated by the center.

REVENUES (INTERNAL vs. EXTERNAL)

Internal revenues are those resources received into a department or organization internal to the University from another department or organization of the University as in a goods and services exchange. Revenues are booked as internal (cost recoveries) revenue using account code 48XX to distinguish them from external revenues. External revenues are those resources received into the university and booked into the General Ledger for the first time from external sources outside the University.

SALARY ROLL (a.k.a. Human Capital Planning HCP)

Generated listing of budgeted vacant positions and active employees with related information provided to Budget Centers for the preparation of budgets during the spring of each year. The salary roll lists the distribution of each salary among account numbers for each permanent classified and unclassified position entered into the position database. The sums of these distributions are transferred to the budget worksheets and included in the total base budget loaded into the Clemson University Business System (CUBS). Training for HCP can be found at https://www.clemson.edu/finance/budgets/ under the heading Training and Events: FY20xx Position Planning Training Manual.

SOURCE AND USE OF EDUCATION AND GENERAL FUNDS STATEMENT

A financial statement that identifies the sources of funds available for spending from revenue increases (decreases) and expenditure increases (decreases) along with the uses of the funds for programs. The statement is used in the planning phase of a new budget to provide a platform for the debate of macro-issues affecting the source and application of new monies. The statement presents the disposition of actual excesses or shortages from the budget estimates as approved by the President and the Provost during the current year.