Graduate School Cost and Aid

Tuition and Fees

How much will your graduate study cost? Tuition and fees for graduate programs at Clemson depend on four variables:

- Your program

- Full-time or part-time status

- Residency

- When you enrolled

Find what your tuition and fees will be quickly on the Tuition and Fee Information page.

Graduate Tuition and Fee Calculator

Assistantships and Fellowships

Graduate assistantships and fellowships are forms of graduate student financial aid that can make graduate education more affordable.

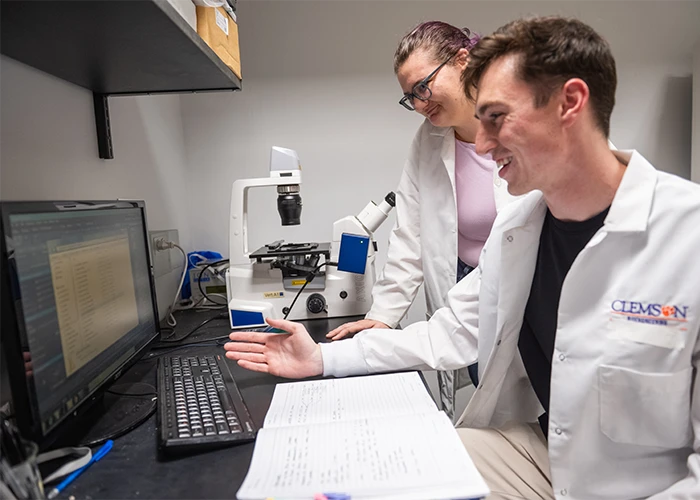

Graduate Assistantships

Graduate assistantships are work agreements in exchange for discounted tuition.

Specifically, graduate assistantships are monetary awards provided in exchange for work in research, administration or teaching that graduate students perform while pursuing their graduate degree. Graduate assistants are compensated through tuition discounts proportional to their weekly hours of service (usually between 10 and 28 hours per week) and an annual stipend, the amount of which varies based on the type and amount of work being performed. Graduate assistants are employed by the University and sponsored by a particular department or unit and must maintain full-time enrollment as defined in the “Assistantships” section of the Graduate Policy and Procedure Handbook.

Policies regarding assistantships, contracts and hours, etc., can be found in the "Assistantships and Fellowships" section of the Handbook.

See Training and Benefits for Graduate AssistantsFellowships

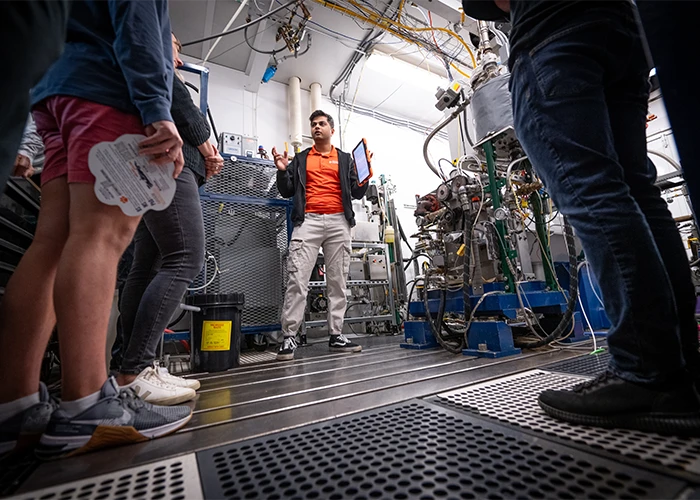

Fellowships are grants that fund a specific type of research or study.

Specifically, graduate fellowships are monetary awards that require no work or service from the student. They may come from the University or from an external organization such as a government agency or a professional association. These are typically awarded based on merit, and for Clemson fellowships, students are nominated by faculty and decided on a competitive basis.

Fellowships often limit the student’s research to a specific area of study designated by the sponsor or may require a period of residency at the sponsoring organization. A fellowship may require a certain course load.

How To Find an Assistantship or Fellowship at Clemson

Assistantships and fellowships at Clemson are offered and managed by individual academic departments, colleges and centers according to the policies in the Graduate Policies and Procedures Handbook.

If you’re interested in applying for an assistantship or a fellowship, check with your program’s department to see if there will be openings or nominations for upcoming semesters. Some programs post their positions online on their own websites, or you can inquire directly with your department’s graduate program coordinator. A few assistantships, usually those open to students in one of several programs, are posted on Clemson Joblink.

Find Your Program

Funding for Travel and External Experiences

Clemson University Graduate Student Government secures grant funding to help support students with travel experiences to conferences, workshops and field study.

Apply for a Travel GrantFederal Aid Programs

See information related to federal aid programs for graduate students on the Student Financial Aid Graduate Funding page.

Student Financial Aid Graduate FundingNote: Clemson University will never request credentials via email, phone or online form.